What to Do When a Customer Refuses to Pay for Work Done

You’ve done the job. You’ve sent the invoice. Now you’re stuck chasing payment.

Sounds familiar?

For tradespeople and small business owners, few things are more frustrating than dealing with a customer who refuses to pay. These unpaid invoices don’t just waste your time and energy; they can seriously harm your cash flow and put the sustainability of your business at risk.

(Plus, it’s about the principle…)

Whether you’re facing a “professional non-payer”, someone in a bit of financial difficulty, or handling a genuine dispute, knowing how to respond is key.

We’ve put this guide together to offer a step-by-step process you can follow, including exactly what your legal rights are here in the UK and how to avoid payment issues in the future.

What Are “Professional Non-Payers”?

The professional non-payer is someone who never intended to pay for a job from the beginning. They request a quote, agree to it, have the work carried out, only to then find an excuse.

Common Tactics of Non-Payers:

- Rejecting invoices with false or unjustifiedclaims about service quality.

- Ignoring payment reminders or communication altogether.

- Suddenly claiming financial struggles with no proof.

- Dragging disputes out as long as possible to delay payments (in the hopes you might just let it go…)

Dealing with these customers can be a nightmare. They impact your time, resources, and mental well-being. However, with the right approach, it’s possible to manage these situations effectively.

What to Do When Someone Doesn’t Pay

1. Stay Professional

No matter how frustrating the situation is, always remain calm and professional. This approach will:

- Save you from unnecessary confrontations.

- Work in your favour if legal action becomes necessary.

- Maintain your reputation in the industry.

Quick Tips:

- Keep all communication in writing. Emails are ideal as you can easily save records.

- Avoid emotional responses in communication. Stick to the facts, but be firm.

- Confirm all verbal discussions with follow-up emails stating what was agreed.

2. Double-Check the Details

Mistakes happen. Before escalating the issue, ensure you’ve followed the agreed terms and invoicing process correctly.

What to Check:

- Review the original contract, quote, or scope of work.

- Confirm that all agreed services were fulfilled on time.

- Ensure the invoice matches the agreed charges.

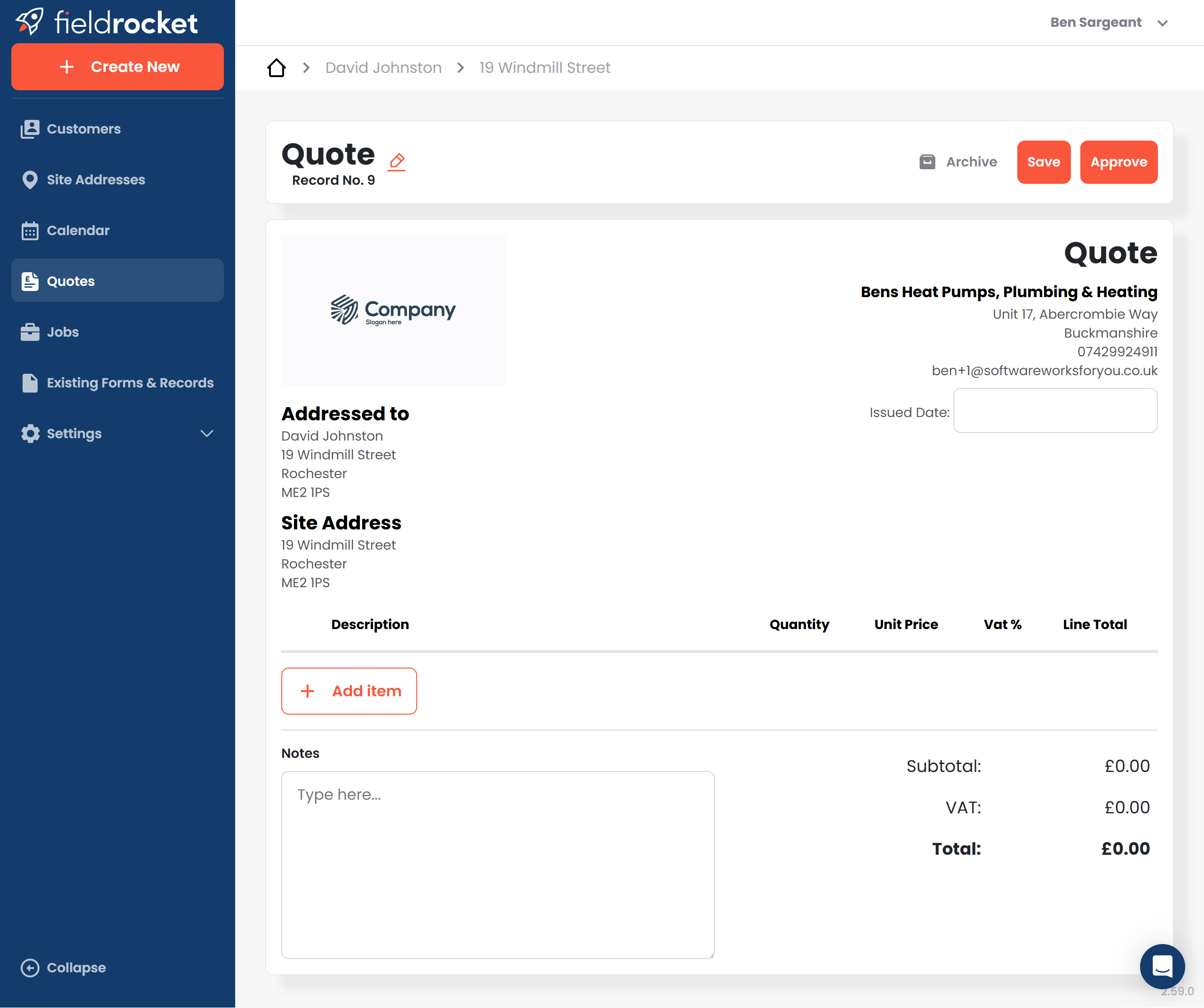

If all looks correct but the customer is claiming they didn’t receive the invoice, resend it. Using job management software (like FieldRocket) helps you track when invoices are sent and received.

Quotes made in FieldRocket are always traceable. You can even prove they were sent to your customer on a certain date.

3. Aim for Resolution

Sometimes, the refusal to pay stems from genuine misunderstandings or issues. Whenever possible, try to resolve the dispute amicably.

Steps to Take:

- Hear Them Out: Ask the customer to outline their concerns in detail.

- Offer Flexible Options: If the customer has genuine cash flow issues, consider offering a payment plan.

- Negotiate: If the dispute involves a small aspect of the work, evaluate whether resolving the issue (e.g., correcting work) is the simplest route forward.

A professional approach can often save time and avoid the hassle of legal proceedings.

4. Know Your Legal Rights

When a resolution isn’t possible, it’s essential to understand your rights as a service provider in the UK. If a customer refuses to pay after all reasonable efforts, you’re within your rights to recover the payment and have a few options:

Your Legal Options for Non-Payment

a) Hire Debt Collectors

A debt collection agency can help recover what you’re owed while maintaining a professional distance between you and the customer. These agencies charge a fee, which is usually calculated as a percentage of the recovered debt.

They may ask you to first send a statutory demand or formal payment request letter, with something like a 7-day deadline. At this point, some agencies will “buy the debt” off of you, and others may start chasing the customer and only take a cut if they’re successful.

Pros:

- It’s relatively hands-off, saving you time and stress.

- Agencies are experienced in dealing with difficult customers.

Cons:

- You do have to pay a fee.

Some great options in the UK include:

- Beaumont Recoveries

- Master Collections

- Glenwood(for construction companies)

b) Send a Statutory Demand Letter

For larger sums (e.g., over £750 for companies), you can issue a statutory demand. This is a formal legal document that requires the debtor to pay the outstanding amount within 21 days. Failure to comply can lead to further legal action.

How to Issue One:

- Download the form from the UK government’s website.

- Ensure the demand is clear and includes all necessary details.

Find out more about issuing a statutory demand letter.

c) Use the Money Claim Online Service

This government-run service allows businesses to file claims for unpaid invoices online, as long as the case is fairly straightforward.

When to Use It:

- The amount owed is clear and undisputed.

- The total claim is under £10,000.

Here’s the link → https://www.moneyclaim.gov.uk/web/mcol/welcome

d) Go to the Small Claims Court

For disputes under £10,000, the small claims court is another option you could take. If the court rules in your favour, the debtor will be legally required to pay the outstanding amount, plus court fees.

However, going down the small claims court route can be more complex and generally has longer waits than going with a debt collection agency.

What to Expect:

- You’ll need to prepare evidence, including contracts, invoices, and email communication.

- Filing fees are typically between 5-10% of the claim amount.

How to Prevent Future Non-Payment Issues

Dealing with non-payment is stressful, but prevention is always better than cure. Here are proven strategies for protecting your business from non-payers.

a) Identify Problematic Customers

Red flags to watch for before taking on a job:

- Excessive bargaining or haggling over price.

- Hesitation around signing contracts.

- A history of avoiding paperwork or clear communication.

- Taking ‘issue’ with some part of your work to get a discount after the job is complete, rather than asking for it to be rectified (however justified/unjustified it may be).

If you’ve had a bad experience with a customer already, don’t work for them again. It’s almost always better to find a new customer who respects your work and values your time.

b) Take Before-and-After Photos

Documenting your work serves as proof of the quality you provide. These photos:

- Protect you against unfounded complaints about the job.

- Serve as valuable evidence in legal disputes.

- Act as an excellent marketing tool to showcase your work.

Troublesome customers may try to blame unrelated issues on your service to avoid paying or getting a reduced invoice. Having clear photographic evidence leaves them no ground to stand on.

c) Have Clear Payment Terms

A detailed contract protects you and any employees you have. Include:

- Itemised costs for all services (for extra clarity and transparency).

- Clear payment terms (e.g., upfront deposit, payment deadlines).

- Penalties for late payments.

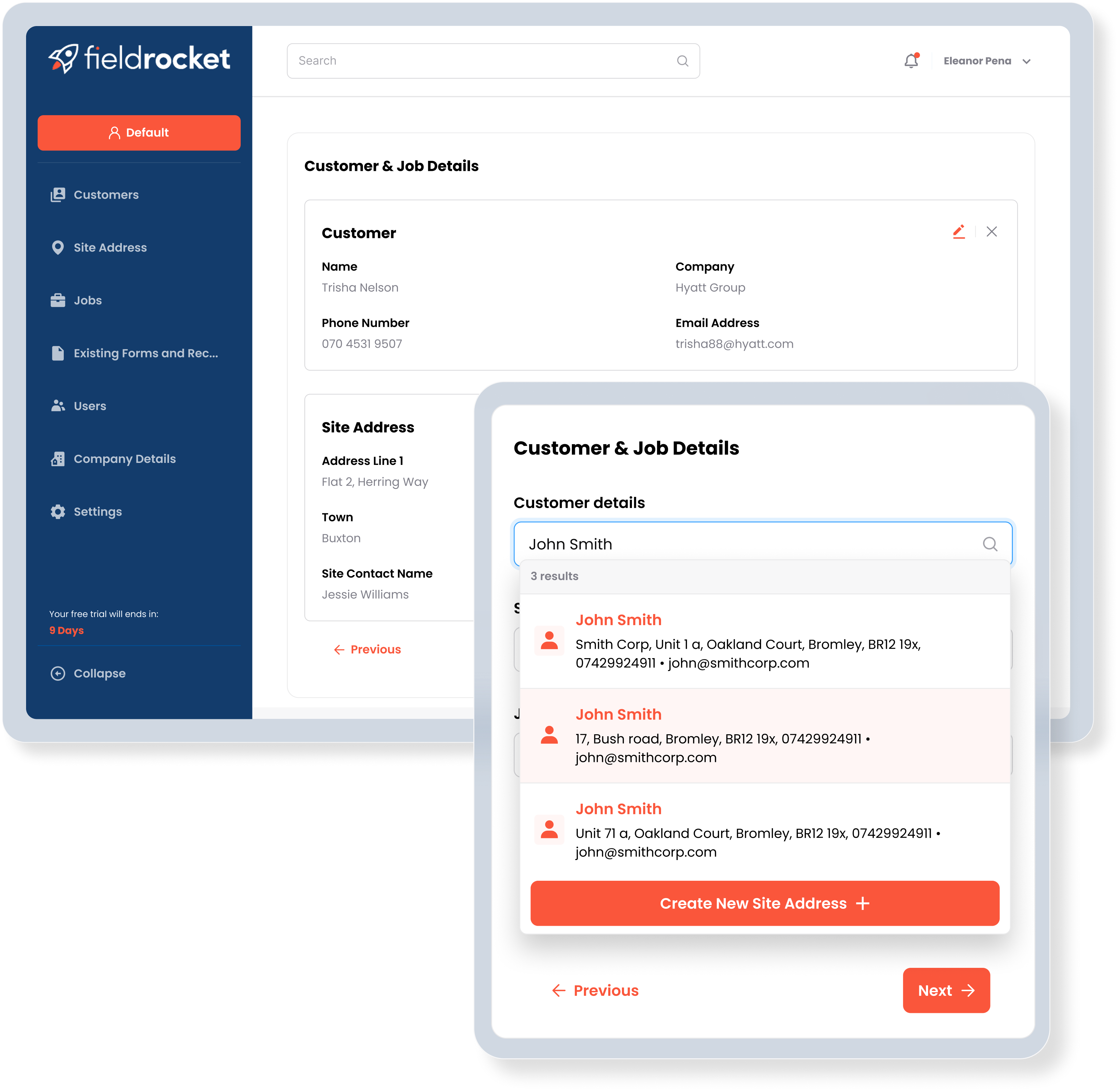

d) Use Job Management Software

Tools like FieldRocket streamline your admin while protecting against non-payment. They enable you to:

- Attach photos and documents directly to job files.

- Store a full communication history for easy reference.

- Easily keep track of jobs

Take Control of Late Payments Today

You should never feel like the easiest route is to just forget about it. Start by staying professional and exploring resolution options, then leverage your legal rights if necessary. Ultimately, the best strategy is prevention—use contracts, detailed documentation, and job management tools to protect your business.

Create, sign, and send all your industry certificates with FieldRocket

Looking for a way to simplify your paperwork? FieldRocket offers customisable, professional & paperless certificates and forms for all trades.

Get started with a 7-day free trial by clicking below.